Energy News – Critical Minerals: Reshaping the Minerals Industry

by Stephanie E. Mills

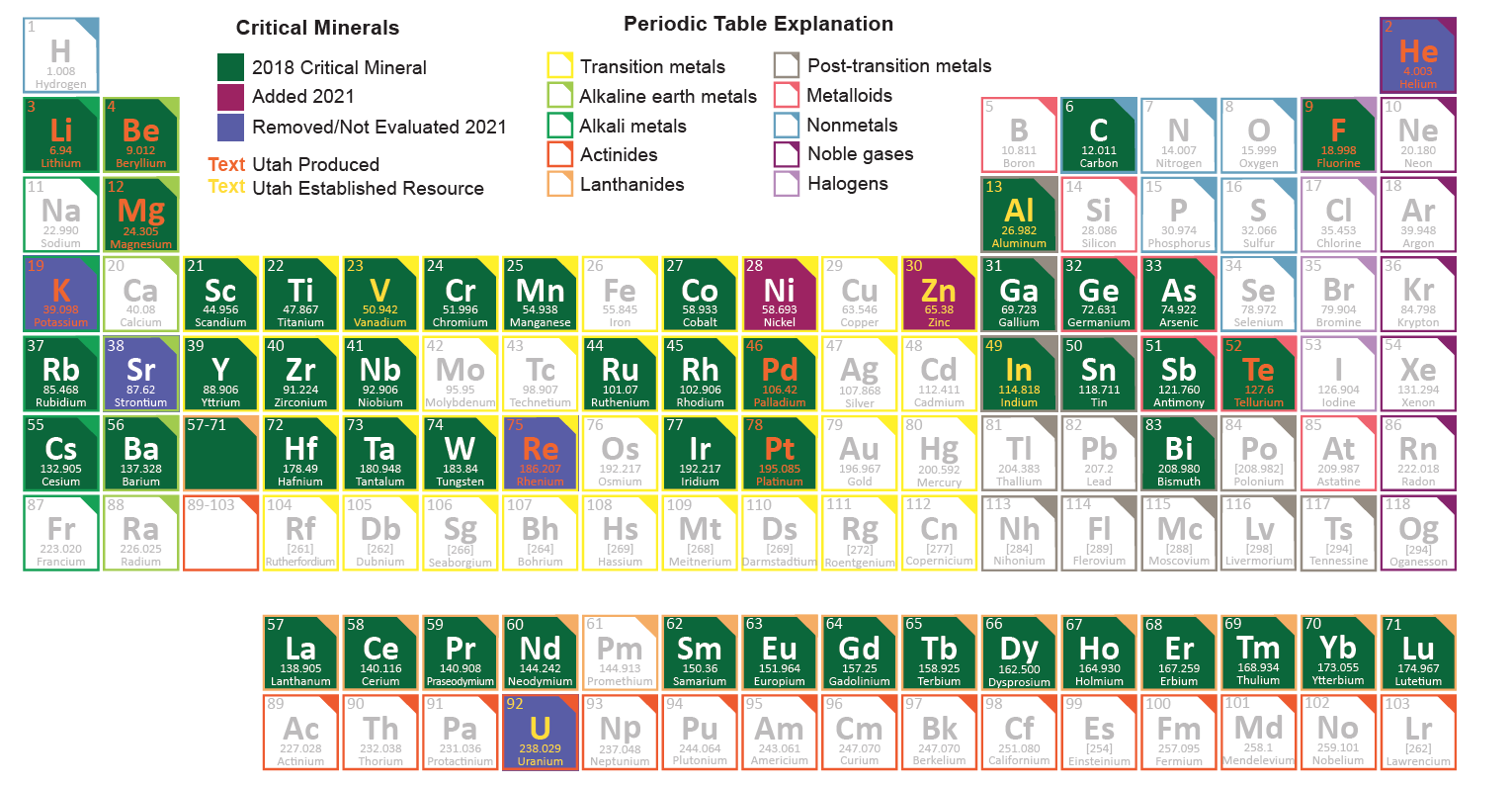

Classification of critical minerals and battery metals. Bold typeface indicates the most commonly cited battery metals.

Anyone who has been paying attention to the mining industry over the past few years will have noticed a shift in the language around commodities. Gone are the simple days of precious versus base metals (with a few bulk commodities thrown in). In the modern market conversation, commodity groups now run the gamut from critical minerals and battery metals to specialty metals, future minerals, energy metals, green metals, and beyond. This complexity of language comes from the realization that modern economies and a shift to carbon neutral energy production are dependent on high-tech devices and new battery technology, which require a wider variety of materials than at any other point in history.

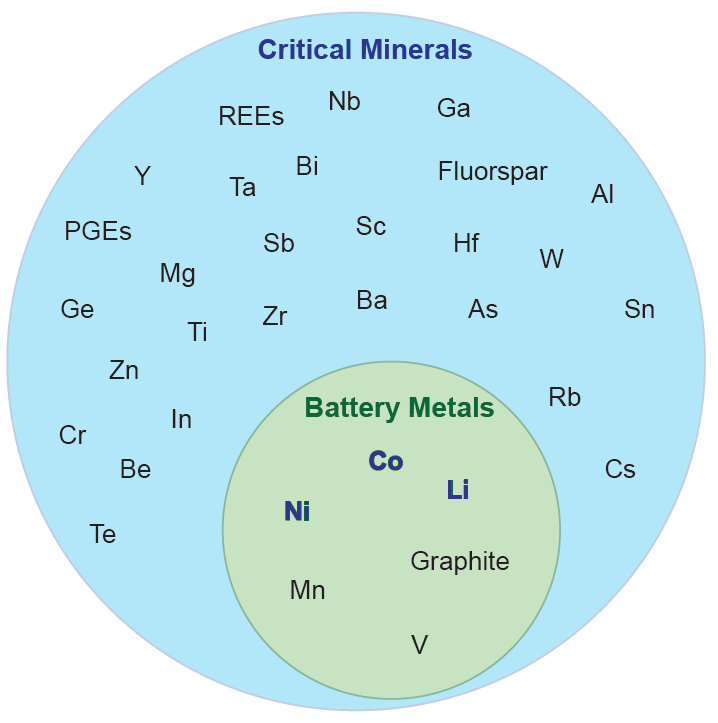

In general, the term “critical minerals” encompasses the commodities in most other mineral groups. Critical minerals refers to a formalized group of mineral commodities defined and published by governmental organizations. Most governments use the same basic definition, that critical minerals are those essential to domestic economy and/or security and that have a supply chain vulnerable to disruption. In the United States, the most recent iteration of critical minerals created by the U.S. Geological Survey (USGS) was published in 2018. However, the list of critical minerals is not static. The USGS reviews the critical mineral list every three years, and the 2021 review identified five commodities that no longer meet the definition of critical mineral (helium [He], potash [KCl and K2SO4], rhenium [Re], strontium [Sr], and uranium [U]), and two new ones that do (nickel [Ni] and zinc [Zn]), for a total of 33 commodities or commodity groups, such as rare-earth elements (REEs) and platinum-group elements (PGEs).

Can we just use the term critical minerals and call it a day? In general, yes. But critical minerals cover a wide range of commodities with very different economic and mining implications, hence the complicated language around commodity subgroups. Below are three of the most common questions about critical minerals.

What about battery metals?

One of the most commonly discussed subgroups of critical minerals are the battery metals, referring to the mineral commodities used in the production of batteries for everything from electric vehicles to renewable energy storage. Battery metals and critical minerals have always had a significant overlap, and in the 2021 critical mineral list update all the commonly cited battery metals (lithium [Li], cobalt [Co], graphite [C], and manganese [Mn]) are now considered critical minerals. Is there any point to singling out the battery metals? Yes! Just because a mineral commodity is considered critical does not mean there is potential for substantial market expansion. Beryllium, for example, is a critical mineral essential to aerospace and defense, but demand is projected to continue at current rates. Battery metals, however, are expected to go through substantial market growth in the near future given the focus on shifting to a carbon neutral economy, and this demand has and will continue to have major impacts on allocation of exploration and development expenditure.

Do critical minerals have any blindspots?

Given that the 2021 critical mineral update contains 33 mineral commodities, it would seem that everything of importance for future economies is covered. However, Utah’s most significant produced mineral commodity, essential to current and future economies across the world, is copper, and copper is not a critical mineral. Other major infrastructure metals like iron (also mined in Utah, with the restart of the Black Iron mine in 2020) and aggregate are also not considered critical minerals. So although critical minerals tell a big part of the story about the future of the minerals industry, many of the traditional mineral commodities will continue to be essential. It is important that government and industry long-term planning continues to include these commodities.

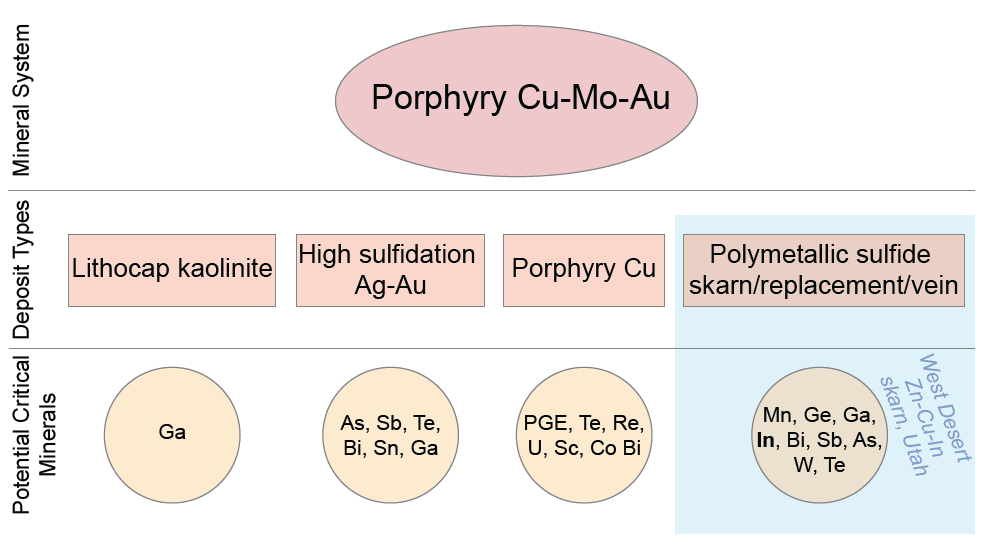

An example of the mineral systems approach to critical minerals exploration, with the West Desert skarn deposit type and critical mineral potential highlighted.

How do we explore for critical minerals?

Critical minerals span every known geologic terrane, and many may not have strong enough economics to support stand-alone mining, such as gallium. How then do we approach critical minerals from an exploration standpoint? The USGS recently published a “mineral systems” approach to critical minerals. The mineral systems approach helps explorationists understand the critical mineral potential of known types of mineral deposits and encourages a holistic view of deposit economics, including consideration of critical mineral byproduct production along with core commodities. A good example of this in Utah is the West Desert skarn deposit in Juab County. Under the mineral systems approach, West Desert can be classified as a skarn deposit in a porphyry mineral system. The mineral systems approach suggests possible enrichment of nine critical minerals in a skarn deposit, one of which is indium. As it turns out, West Desert hosts an established resource of indium, the only known indium resource in the United States and enough indium to cover U.S. indium consumption for more than 15 years, based on 2020 imports. This demonstration of the mineral systems model shows how important it can be to remove blinders, especially in an exploration phase, and consider all the mineral potential in a deposit.