Energy News – Potential Impacts of the Inflation Reduction Act on Carbon Capture and Storage in Utah

by Julia Mulhern, Ph.D.

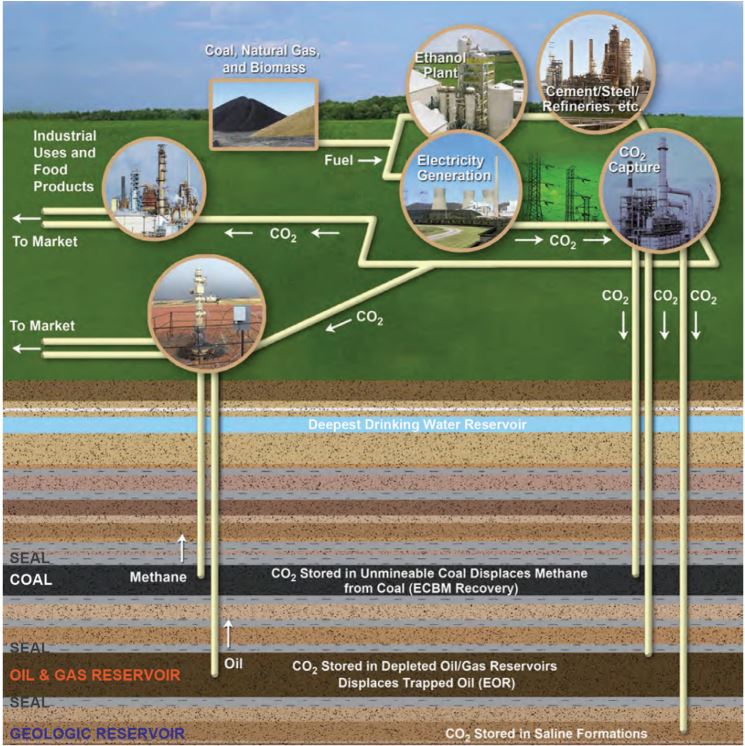

Schematic diagram showing how CO2 is captured, utilized, and stored. Modified from Gray, 2012, U.S. Department of Energy, Office of Fossil Energy, Carbon Utilization and Storage Atlas, fourth edition.

The Inflation Reduction Act (IRA), which aims to reduce U.S. greenhouse gas emissions by roughly 40 percent by 2030, was signed into law in August 2022. The act increases the economic incentives of Carbon Capture Utilization and Storage (CCUS) for the private sector by introducing a variety of provisions that increase the magnitude and applicability of “45Q tax credits” associated with CCUS projects.

What is CCUS?

CCUS generally describes all parts of the process of gathering carbon dioxide (CO2) from the atmosphere or other point sources (e.g., power plants and petroleum refineries) and either using it (utilization) or storing it (sequestration) in underground geological formations (see Survey Notes, 2022, v. 54, no. 2). Industrial facilities, such as power plants, chemical plants, and iron, cement, and gas processing plants are fundamental to society and the economy; however, they produce significant CO2 emissions that contribute to global warming. These industrial facilities are considered point sources of emissions because they emit a relatively dense volume of greenhouse gas into the atmosphere at a single location. These facilities can be designed or retrofitted with carbon capture technology to gather CO2 on site and pump it into underground rock formations, where it is trapped for long periods of time, rather than allowing it to enter the atmosphere. CO2 can also be removed from the atmosphere through direct-air-capture (DAC) technology, a flexible and scalable burgeoning technology that involves building complex machinery that removes CO2 directly from the air, but this technology currently requires more energy to capture CO2 than re-designing or retrofitting point-source facilities. CCUS was proposed as early as 1977, but it has not yet been widely deployed due to lack of incentives—the process takes considerable energy to capture, compress, and reinject CO2 into the ground and these energy costs, as well as infrastructure costs, have been previous and persistent hurdles for economically viable CCUS projects. However, the IRA increases relevant tax credits, thus making projects more viable and encouraging greater participation in CCUS by the private sector.

What are the 45Q tax credits and how were they changed in the Inflation Reduction Act?

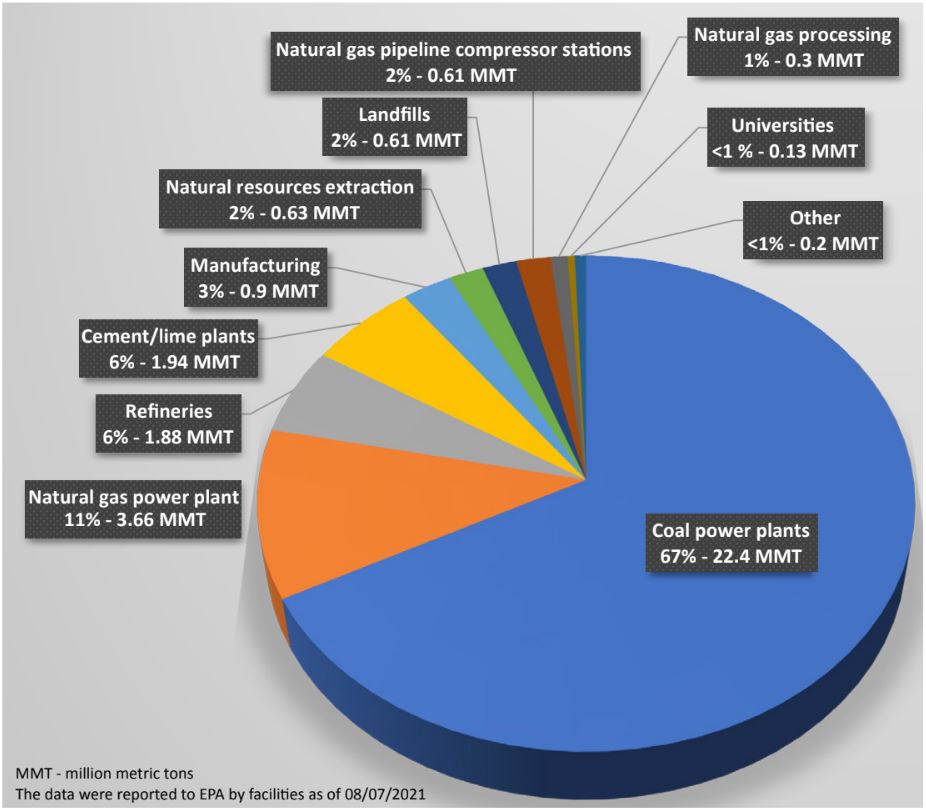

Emissions data for Utah showing the percentage of emissions from various large-scale industrial facilities based on EPA FLIGHT dataset https://ghgdata.epa.gov/ghgp.

The “45Q tax credits,” named after Internal Revenue Code Section 45Q, are tax credits provided for the capture and either storage or utilization of carbon oxides (CO), which are a more generalized group of gases that includes and is dominated by CO2. These credits were originally established in 2008, reformed in 2018 as part of the Build Back Better Act, and adjusted in 2021 to further incentivize participation in the program. The 2022 IRA makes the following changes to 45Q credits:

- Increases the credit amounts per metric ton captured from:

- $50 to $85 per metric ton for point-source capture,

- $35 to $60 per metric ton for point-source CO used for enhanced oil recovery (EOR),

- $85 to $180 per metric ton for direct-air-captured (DAC) CO that is stored, and

- $35 to $130 for direct-air-captured CO that is utilized.

- Lowers the annual carbon emissions threshold for facilities to qualify for the credit from:

- 500,000 to 18,750 metric tons for power plants,

- 100,000 to 12,500 metric tons for industrial facilities, and

- 100,000 to 12,500 metric tons for DAC facilities.

- Allows direct pay (payments rather than tax deductions) and transferability for tax credit amounts:

- corporate projects receive direct pay for the first 5 years after the carbon capture equipment is placed in service, and

- non-profit organizations and co-ops can receive direct pay for all 12 years of the credit.

- Extends the start date deadline for project construction from January 1, 2026, to January 1, 2033.

In summary, the tax credit value per metric ton of CCUS has increased, more facilities are eligible for sequestration tax credits, DAC is additionally incentivized, and these credits are easier for companies to realize through direct pay, allowing companies to redeem offsets independent of their other tax burden. Combined, these measures may give industrial facilities for steel, cement, refining, and other manufacturing, which produce hard-to-abate CO2 emissions, an economically viable option for CCUS. Although the cost specifics of CCUS are situational, the increased credits give companies the added incentive to market their products as being produced with low or no emissions.

Industrial facilities eligible for the revised IRA 45Q tax credits in Utah based on 2020 annual emissions data from EPA FLIGHT dataset https://ghgdata.epa.gov/ghgp.

How do these changes impact CO2 storage feasibility in Utah?

With an abundance of sandstone, limestone, and basalt rock layers, Utah has favorable geology for long-term geologic sequestration of CO2 which requires both porous reservoir rock layers into which CO2 may be injected and non-porous confining seal rocks, such as mudstone or salt, that over- lie the reservoir rocks and trap the CO2 in place underground. This geology makes Utah a great location for both adding CCUS facilities to existing infrastructure (such as coal-fired power plants) and developing future industrial facilities close to emissions point sources where sequestration could take place on site. The new IRA provisions increase the potential for CCUS in Utah, specifically:

- The IRA increases the number of eligible facilities in Utah from 41 to 62 based on the reduced thresholds for annual emissions, resulting in qualifying facilities distributed across the state.

- The increase in 45Q credits to $85 per metric ton for point-source emissions could have substantial economic benefit to businesses across the state, including increasing the viability of retrofitting coal-fired power plants with CCUS technology. Emissions from coal-fired power plants currently make up 67 percent of Utah’s annual greenhouse gas emissions, a total of 22.4 million metric tons (MMT) annually. These emissions will decrease as Intermountain Power Project is closing its coal-fired power plant near Delta, Utah, by 2025; however, the plant is being rebuilt as a natural gas/hydrogen power plant which could include CCUS. Retrofitting power plants with CCUS would lessen the environmental impacts of electricity generation in the state. For example, the Hunter Power Plant in Emery County emits about 8 MMT of CO2 each year. If roughly 80 percent of that CO2 was captured and stored geologically it would lead to a credit of about $538 million annually.

- Detailed, site-specific cost assessments for infrastructure installation and operational expenses would need to be done to determine retrofit feasibility and economic upside.

- With the increased 45Q credits, active and declining oil and gas fields in the Uinta Basin could become targets for enhanced oil recovery (EOR). EOR, which is the injection of CO2 into oil and gas reservoirs to increase pressure and bolster production, allows hydrocarbon resources to be fully extracted from existing oil and gas fields, making best use of existing resources and infrastructure.

- Utah has abandoned oil and gas wells which can be accessed by existing well infrastructure that could be retrofitted and utilized for CO2 storage without incurring significant, new environmental impacts.

- In addition to having geology that favors CCUS, Utah is rich in geothermal resources. CCUS has the potential to couple with geothermal energy production; however, this technology is currently in the developmental stages.

- DAC facilities could be developed in Utah to take advantage of the attractiveness of geologic reservoir-seal pairs not near CO2 point sources.

The 45Q tax credits create more economically viable opportunities for industrial facilities and companies in Utah to reduce emissions and meet the climate goals set forth by the federal government.

How is the Utah Geological Survey involved?

The Utah Geological Survey (UGS) has been involved in CCUS projects since 2003, often partnering with the Energy & Geoscience Institute at the University of Utah. In the past few years, the UGS has contributed geological expertise to Department of Energy-funded grants that assess the viability of geological CO2 sequestration in Utah. Specifically, the UGS is currently performing a statewide assessment of CCUS potential as well as more detailed projects assessing the viability of injection in specific locations. Moving forward the UGS will continue to provide geologic support for feasibility and implementation projects, advance CCUS research, and gather and disseminate information on CCUS opportunities within Utah.