Energy News: Impacts of the COVID-19 Pandemic on Utah’s Energy Industry

by Michael D. Vanden Berg

The COVID-19 pandemic has significantly changed everyday life around the world and in Utah. Starting in mid-March 2020, state leaders issued stay-at-home directives to try and limit the spread of the coronavirus. This lockdown had major consequences on all aspects of life, including the energy economy in Utah. At the time of this writing (late July), the economy has started to reopen, but new COVID-19 cases continue to surge, leaving doubts about the immediate and long-term economic impact of this pandemic. This article highlights some of the more important and interesting energy metrics from spring 2020 that showed dramatic changes due to COVID-19 responses

The most significant impact on the energy economy of the COVID-19-related shutdown was the massive drop in oil prices. Two events occurred in March 2020 that dramatically changed oil prices worldwide—Russia and Saudi Arabia entered into an oil price war, flooding the market with new supply, and at the same time, the world experienced a massive drop in petroleum product demand linked to COVID-19-related travel restrictions. These two events culminated on April 20, when May futures prices for West Texas Intermediate (WTI—U.S. oil price benchmark) went negative (-$37 per barrel) for the first time in history. Similarly, the price for Uinta Basin wax (UB wax) dropped to an unprecedented -$50 per barrel. Prices rebounded in late April and early May as Russia, Saudi Arabia, and other OPEC+ countries agreed to massive oil production cuts, combined with a more economically driven production decline in the United States due to reduced drilling activity.

Data sources: U.S. Energy Information Administration; Utah Division of Oil, Gas and Mining; Big West Oil price bulletin

The graph above displays monthly average oil prices for WTI and UB wax, coupled with monthly Utah oil production in thousand barrels per day (bbl/day) over the past six years. UB wax sells at a discount due to the limited Salt Lake City refinery market and the challenges of handling the waxy crude. The price crash experienced in late 2014 can help inform how the current price crash will impact oil production over the next several months. Average monthly oil prices bottomed out in April 2020 before rebounding in May, June, and July. Unfortunately, despite this price rebound, Utah’s drill rig count fell from eight rigs in early April to zero rigs in early May. Recent drilling mostly focused on horizontal wells in the unconventional Green River/Wasatch play in the Uinta Basin, Utah’s major oil-producing area. These unconventional wells experience steep production declines in the first several months and without constant new drilling, overall production declines will be significant.

After a sustained decrease in oil production over the past 12 months, mostly related to stagnating prices and operator turnover in the Uinta Basin, production plummeted by 27 percent from 93,000 bbls/day in March 2020 to 67,500 bbls/day in May, due to COVID-19-related price reductions—by far the largest two-month decrease in decades. Unfortunately, production will continue to drop, albeit at a lower rate, well into the fall. Early projections indicate that production could drop to about 55,000 bbls/day by fall 2020, the lowest rate in over ten years. These projections would translate to a total 2020 Utah production of about 25 million barrels, down 32 percent from the 2019 total of 37 million barrels.

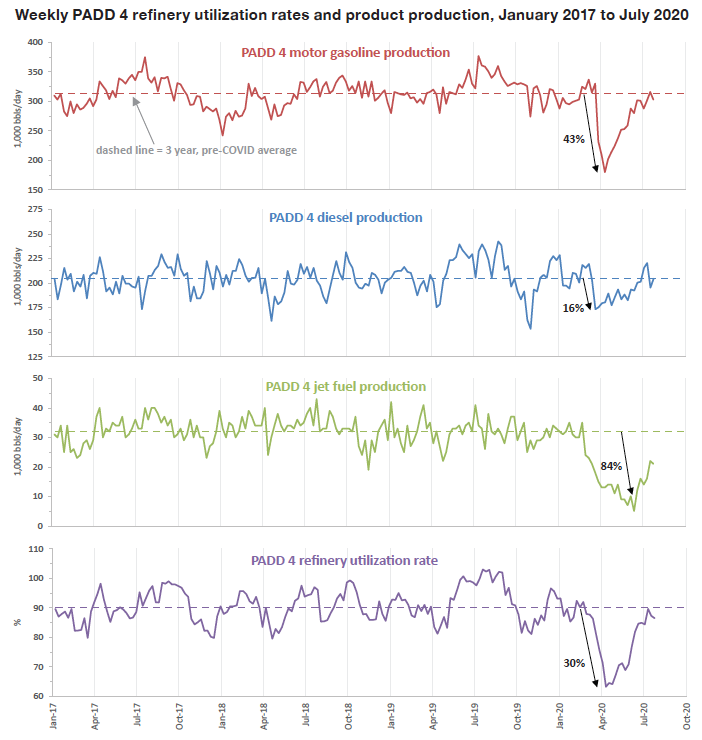

As previously mentioned, the COVID-19-related travel restrictions and stay-at-home orders created an unprecedented drop in petroleum production demand. This dramatic decrease can be evaluated by looking at the drop in PADD 4 (Petroleum Administration for Defense Districts; PADD 4 includes Utah, Colorado, Wyoming, Idaho, and Montana) refinery utilization rates and refinery production of motor gasoline, diesel, and jet fuel. Refinery utilization rate refers to the proportion of time a refinery operates in relation to its full capacity. Typically, refineries operate at about 90 percent of their full capacity; however, this rate dropped to 63 percent in April 2020 due to reductions in demand. As states reopened their economies in May and June, demand for products returned and rates bounced back to nearly 90 percent. Motor gasoline produced at PADD 4 refineries displays a similar trend. A massive 43 percent decrease occurred in early April, followed by a sharp rebound as production returned to normal by the end of July. Diesel fuel demand only dropped 16 percent in late March and quickly rebounded to pre-COVID-19 averages, since commercial trucking never really stopped during the shutdown. Jet fuel demand dropped the most (84 percent) and has yet to fully recover as commercial air travel continues to suffer from mandated travel restrictions.

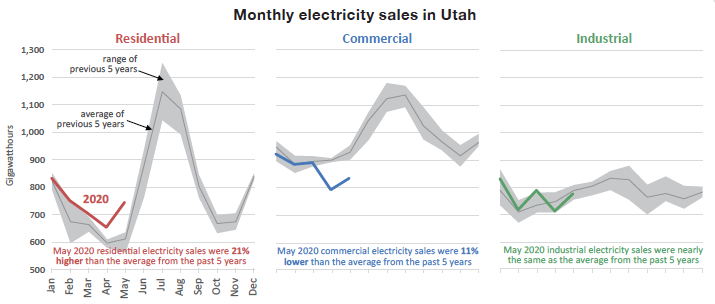

The petroleum industry was not the only energy sector affected by the COVID-19 stay-at-home guidelines; electricity demand in Utah was also impacted. Residential electricity usage increased by 9 percent in April 2020 and 21 percent in May, compared with the average of the past five years. This increase was expected as many Utahns transitioned to working from home and schools shut down. In contrast, commercial electricity usage dropped 13 percent in April and 11 percent in May as most businesses had to shut down, at least temporarily. Industrial electricity demand remained steady as factories and other industrial complexes mostly continued to operate. Electricity demand should generally return to normal in summer 2020 (data only currently available through May) as the economy begins to reopen, but a resurgence in COVID-19 infections could change this scenario.

The COVID-19 pandemic has dramatically impacted all aspects of life in Utah and beyond. These impacts have rippled through our economy, affecting some industries more than others. Utah’s upstream petroleum industry was severely impacted, and the effects of reductions in price, production, and related jobs to Utah’s rural economy will be difficult to manage for many months, if not years. In contrast, demand for petroleum products in Utah has already mostly rebounded and impacts on electricity demand have been minimal and short-lived. As new virus infections continue to surge in July, impacts and restrictions might endure well into the fall, further impacting Utah’s energy economy. The Utah Geological Survey will continue to monitor the effects of COVID-19 on Utah’s energy industry.